Yellow

A bold and flashy statement piece in eye-catching yellow, this design perfectly embodies the fearless and adventurous go-getter in you.

Avatar

If exclusivity is your thing, these limited-edition designs depict iconic figures curated from the Cyberpunk series by NFT Collective Theirsverse. Available in limited quantities, so snag yours early.

Black

This sleek and sophisticated look in black will make a stylish addition to your wallet. A pop of yellow guarantees you’ll still turn heads.

Choose your

Rewards

Rewards

miles

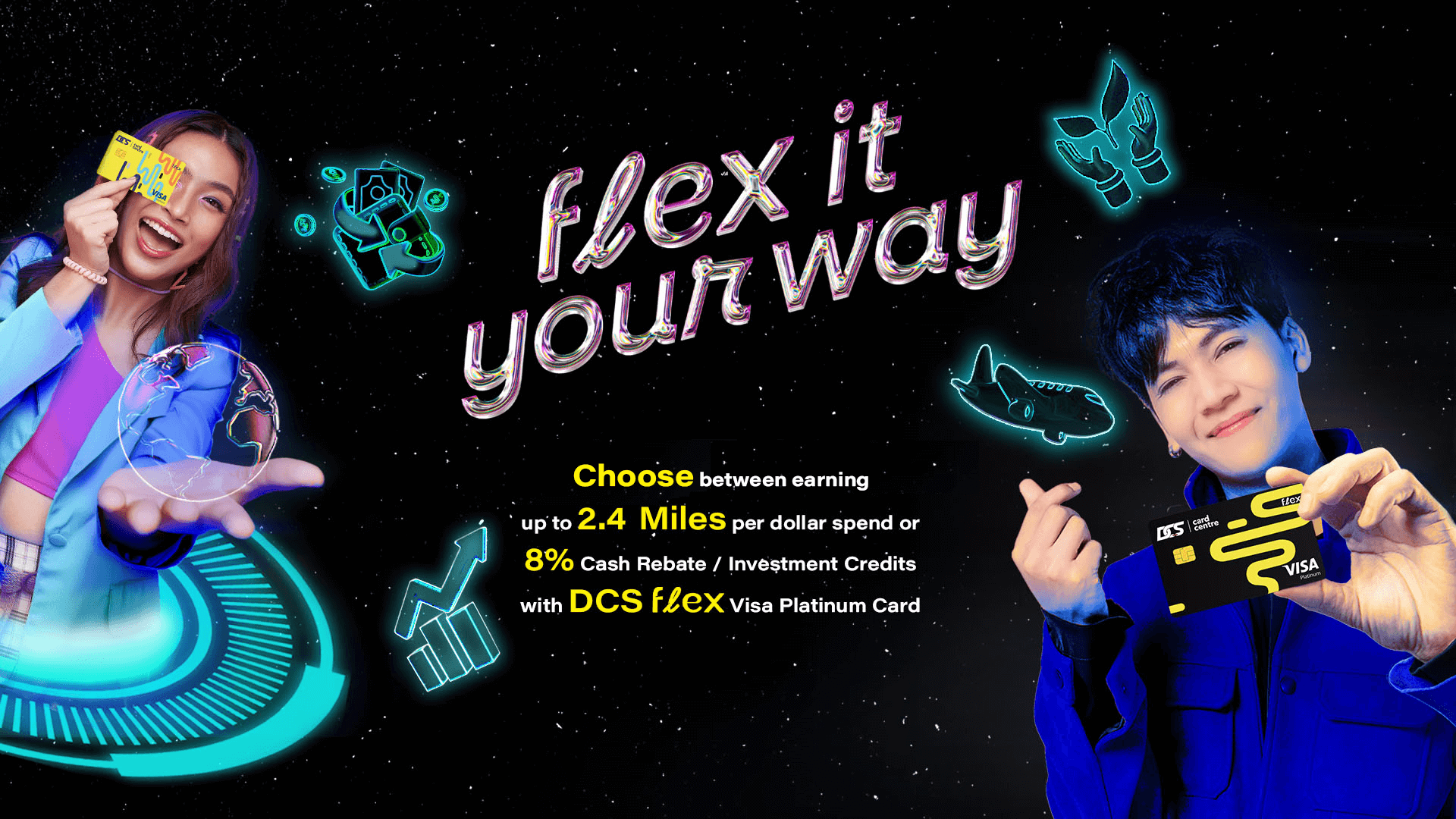

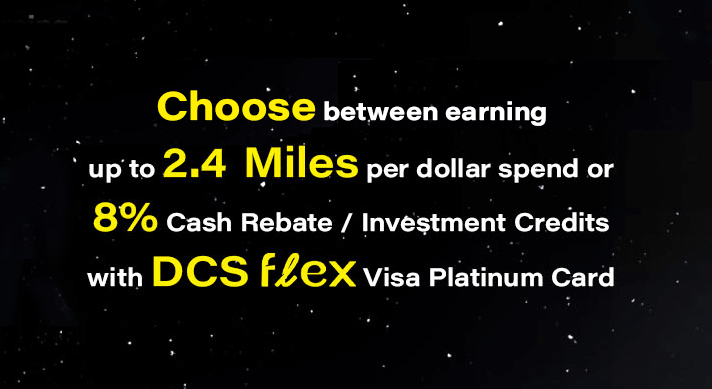

Unlock a World of Miles with Our Rewards Programme!

Discover the power of your spending with our incredible rewards programme. Get ready to soar with up to 2.4 miles for every S$1 you spend, and watch your miles accumulate like never before!

When you meet the minimum monthly spend of $$600, you'll enjoy the following benefits:

2.4 miles per S$1 on foreign currency spend.

1.8 miles per S$1 spend on online transactions in SGD.

1.8 miles per S$1 spend on contactless purchases in SGD.

0.4 miles per S$1 spend on all other purchases.

| Spend | Category | Amount | Miles Earned |

| Bus and train rides via SimplyGo |

Contactless | S$120 | 216 |

| Local dining spend | Contactless | S$140 | 252 |

| In-store shopping (e.g. Sephora) |

Contactless | S$60 | 108 |

| Online shopping (e.g. Shein) |

Online | S$80 | 144 |

| Spend in foreign currency (e.g. JPY) |

Foreign currency | S$160 | 384 |

| All other spend | Others | S$40 | 16 |

| Total | S$600 | 1,120 |

Capped at 750 Miles per category, total 3,000 Miles across all 4 categories.

Miles will be credited to a Miles holding account on statement cycle date. Cardmembers can initiate Miles transfer to Krisflyer account anytime, subject to a minimum transfer of 5,000 Miles and in multiples of 5,000 Miles. Please allow up to 15 working days for the conversion of Miles.

A conversion fee of S$25 (subject to GST) applies for each redemption request.

Even if you don't meet the minimum monthly spend of S$600, you'll still earn 0.4 miles per S$1 spend on all your purchases.

investments

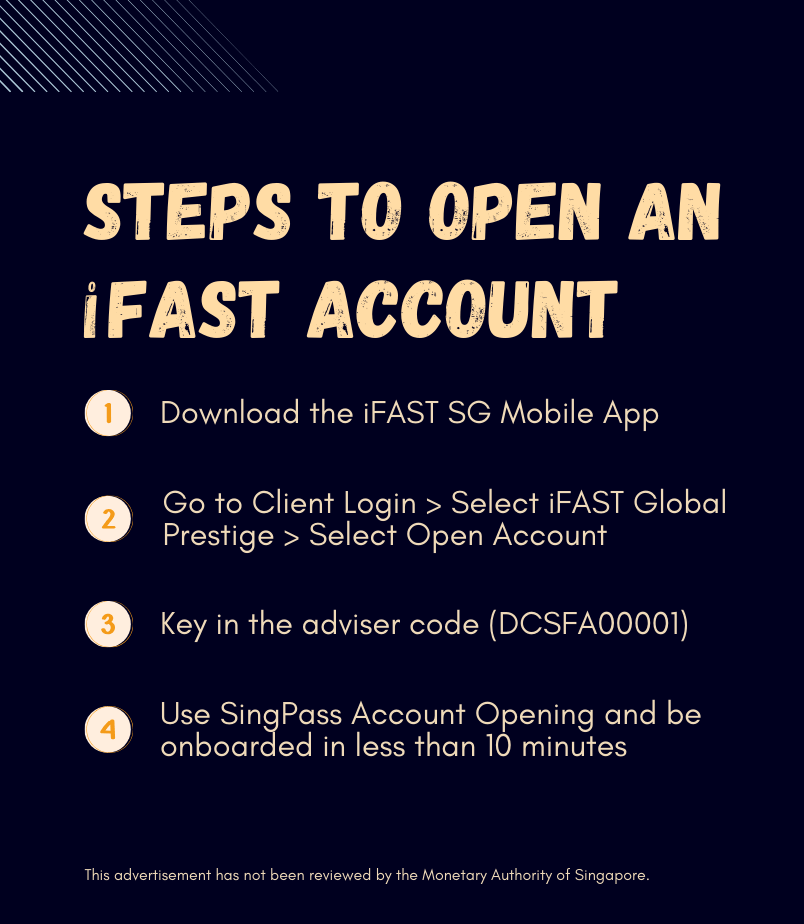

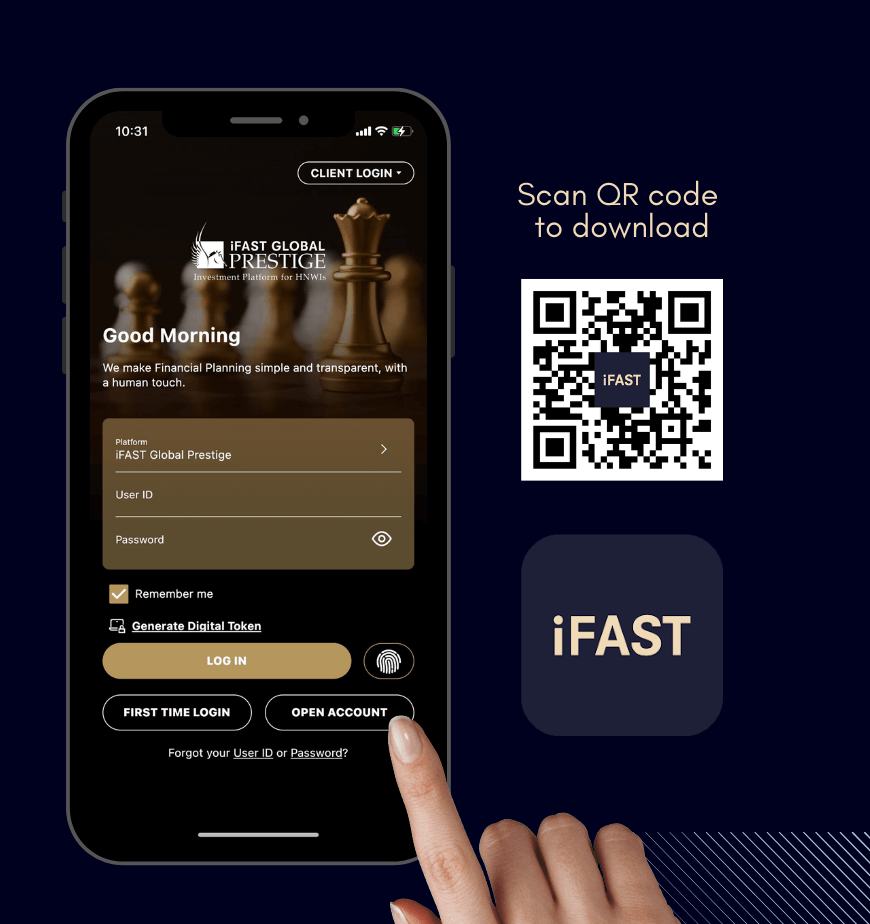

Unlock a World of Investment Credits!

With our exclusive offer, you can enjoy up to 8% Investment Credits that make every purchase feel like a win-win!

When you meet the minimum monthly spend of S$600, the rewards flow:

8% Investment Credits on foreign currency spend.

6% Investment Credits on online transactions in SGD.

6% Investment Credits on contactless purchases in SGD.

0.3% Investment Credits on all other purchases.

| Spend | Category | Amount | Investment Credits Earned |

| Bus and train rides via SimplyGo |

Contactless | S$120 | S$7.20 |

| Local dining spend | Contactless | S$140 | S$8.40 |

| In-store shopping (e.g. Sephora) |

Contactless | S$60 | S$3.60 |

| Online shopping (e.g. Shein) |

Online | S$80 | S$4.80 |

| Spend in foreign currency (e.g. JPY) |

Foreign currency | S$160 | S$12.80 |

| All other spend | Others | S$40 | S$0.12 |

| Total | S$600 | S$36.92 |

Investment Credits are capped at S$25 per category, total S$100 across all 4 categories.

Investment Credits will be credited to cardmember's designated iFast account in the following month.

If you don't quite reach the S$600 minimum monthly spend, you still get something extra in your pocket with a 0.3% Investment Credits on all your spending.

cash rebates

Unlock Your Ultimate Savings Potential!

Discover a world of rewards with our Cash Rebate Program and save with every spend!

Achieve a minimum monthly spend of S$600 and save with every spend.

8% Cash Rebate on foreign currency spend.

6% Cash Rebate on online transactions in SGD.

6% Cash Rebate on contactless purchases in SGD.

0.3% Cash Rebate on all other purchases.

| Spend | Category | Amount | Cash Rebate Earned |

| Bus and train rides via SimplyGo |

Contactless | S$120 | S$7.20 |

| Local dining spend | Contactless | S$140 | S$8.40 |

| In-store shopping (e.g. Sephora) |

Contactless | S$60 | S$3.60 |

| Online shopping (e.g. Shein) |

Online | S$80 | S$4.80 |

| Spend in foreign currency (e.g. JPY) |

Foreign currency | S$160 | S$12.80 |

| All other spend | Others | S$40 | S$0.12 |

| Total | S$600 | S$36.92 |

Cash Rebate is capped at S$25 per category, total S$100 across all 4 categories.

Cash Rebate will be credited to Cardmember's Card Account in the following statement.

But don't worry, even if you don't reach the minimum monthly spend of S$600, you still get 0.3% Cash Rebate on all spend.

switch it

Coming Soon...

Other Features

Rewards Tracker

Monitor your spending and rewards earned via the DCS Cards App

Take control of your reward earnings with our Rewards Dashboard. Track and manoeuvre your spending across various spend categories and watch your rewards grow as you meet those minimum spend goals.Make every dollar count! Start your journey towards smarter spending and amazing rewards today!

Pay Conveniently via Apple Pay and Google Pay

DConvert Instalment Plan

Discover the freedom of breaking down your big ticket purchases into instalments, available for transactions of S$300 or more:

0% Interest Instalments

Say goodbye to the stress of high-interest rates.

Flexible Payment Terms

Choose from 3, 6, or 12 months, tailored to your needs.

Affordable Processing Fees

For 3, 6 and 12-month instalment plans, the processing fees will be 3%, 5% and 8% respectively.

Increase Your Spend Limit

Boost your spending power by linking your DCS Flex Visa Platinum Card to your D-Vault virtual account.

Top-up conveniently with digital assets or bank transfers and see your card spend limit increase instantly. It’s that simple!Complimentary Travel Insurance Coverage

Unlock Peace of Mind with Every Adventure!

Elevate your travel experience with the DCS Flex Visa Platinum Card and revel in the luxury of complimentary travel insurance coverage, ensuring you're protected up to S$1 million.Simply book your entire journey, from airfare to travel packages with your card, and embrace the freedom to explore with the confidence that you're safeguarded every step of the way.

Overseas Cash Advance

Access Cash Abroad with Ease!

When you're overseas and in need of quick cash, we've got your back. Enjoy instant cash withdrawals at any international ATMs or banks displaying the Visa / Plus logo.

Note: Cash Advance fee & charges apply.

Eco-friendly Card

Crafted with eco-conscious innovation, the DCS Flex Visa Platinum Card harnesses the power of 82% recycled plastic to bring sustainability and style together in perfect harmony.

Big Spend, Bigger Rewards

From 1 April to 31 May 2025, get rewarded with extra 2% Cash Rebate on your spend. Top spender gets a pair of Limited Edition Nike x Tiffany & Co. Air Force 1 1837 sneakers (worth US$400)!

Learn more

Perks

Perks

Discover our collection of spectacular masterpieces, meticulously crafted to celebrate your unique love story

- Exclusive 12% discount on your purchases

- Complimentary Aimo fashion jewellery with purchase

- A chance to participate in the Aimo Anniversary Lucky Draw every year

- Every S$1 Card Transaction at Aimo Haute Jewelry is eligible for 6 times Imperium Points (equivalent to 2.4 miles).

Make an appointment today

Call: +65 6904 8243 | WhatsApp: +65 9439 6121

or email us at info@aimosg.com

Store: 391A Orchard Road, Ngee Ann City Tower A #23-05, S238873

Terms & Conditions Apply

Terms & Conditions Apply

Click here for required documents

Documents Required for DCS Card Application

Singapore Citizen/Permanent Resident

- Copy of NRIC (Front & Back); AND

- Income document (Please refer to the list of income documents* as below); AND

- Proof of Resident if billing address and NRIC differs (Please refer to the list of proof of billing address# as below)

Foreigners

- Copy of Passport; AND

- Employment Pass with minimum validity of 12 months; AND

- Proof of billing address#; AND

- Proof of Employment e.g., appointment or company letter; AND

- Income documents* (Please refer to the list of income documents* as below)

*List of Income Document

| Fully Salaried | Commission / Variable Income Earner | Self Employed |

|---|---|---|

|

|

|

#Proof of billing address

- IRAS certificate of stamp duty

- Utility bills

- Bank Statements

- Government issued Documents indicate current address

Age

21 to 65 years old

For Foreigners

Minimum income of S$60,000 p.a.

For Singapore Citizens and Permanent Residents

Minimum income of S$30,000 p.a. OR S$15,000 p.a. (age 56 & above)

Principal Card

Monthly Service Fee: S$15^

(waived for first 12 months)

Enjoy subsequent monthly service fee waiver when you make minimum of 5 transactions per month on your principal card

Supplementary Card

Monthly Service Fee: S$7.50^

(waived for first 12 months)

Enjoy subsequent monthly service fee waiver when you make a minimum of 5 transactions per month on your supplementary card

One-time Card Design Fee (for Limited Edition Card): S$20^

Ready to Flex?

Apply for your card now!

Download the DCS Cards App

on your mobile device.

Select the Flex Card and follow the instructions.

OR